Six charts that explain the market right now.

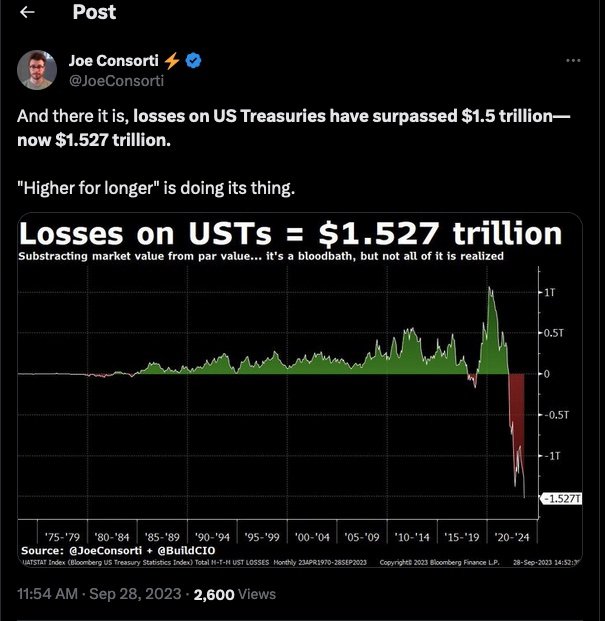

I have commented more than once about the risk of duration in my remarks this year. While I don’t predict rate moves, I do look to avoid unnecessary risk…and being exposed to duration is not good right now.

Setting up the six charts: Eight points to keep it simple.

1. Per the Fed’s remarks last week, interest rates will remain at current levels (and possibly higher) for longer. This is one of two reasons for the current market sell off.

2. The second reason is that the Fed no longer believes an economic soft landing is a high probability. So the Fed seems to admit a recession is coming. Raising rates into a recession is nearly unprecedented, but so is the ongoing trouble with inflation.

3. Since the Fed meeting September 20th: the S&P500 and bonds have sold off a bit, both declined about 5% in less than a week’s time.

4. 10-year treasury yields have moved from 4.0% to 4.6% in a few months (that’s a lot). It looks like 30-year mortgage rates are about to touch 8%. Remember, the US economy runs on credit and it is getting much more expensive to operate with debt.

5. Traditional 60/40 is not doing well. Stocks and Bonds declining together is not common and this is penalizing traditional 60/40 portfolios.

6. The US equity market is being held up by less than 10 stocks. Meta, Apple, Alphabet, Amazon, Netflix, Nvidia and Microsoft have been dubbed the magnificent seven.

7. Which means all of 60/40 is basically being held up by 7 stocks.

8. People aren’t even selling; major stock and bond ETFs are seeing big inflows.

So rates continue to rise and bond funds are getting slow walked into a wood chipper. In contrast, buying short-term treasuries and holding them to maturity has been great, earning 4.0% to 5.0% yields, letting them mature…then buy another one at a slightly higher market rate. Money Market Funds (a cash alternative) are also paying nearly 5%...it’s never been better to be both patient and cautious.

Despite the current weakness, it’s been a strong year for the S&P500, but the leadership is very narrow. The equal weighted S&P500 demonstrates there is a lot of weakness among the other 493 stocks in the S&P500.

In my view, market uncertainty is high. I’m heavy cash, short-term treasuries and dollar cost averaging into various US Equity exposures. I’ve also commented in the past about my interest in the Energy and Uranium sectors and both have been on a tear.